ABB Ltd is a multinational corporation that specializes in the production of power grids, industrial automation, and robotics. Founded in Switzerland in 1988, ABB has grown to become a global company with operations in more than 100 countries. One of its main business segments is the converter business, which provides high-voltage direct current (HVDC) technology for power transmission and distribution.

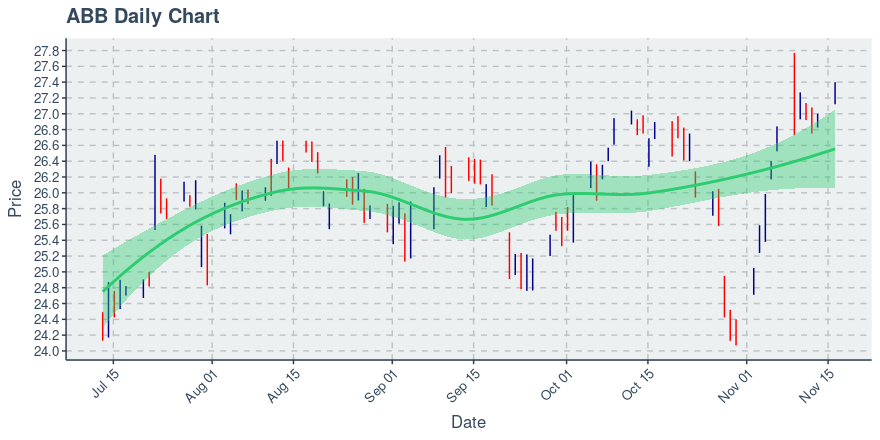

If you are interested in investing in ABB Ltd or just want to keep track of the company's stock price, you can easily do so by checking out the ABB depositary receipt chart on TradingView. This online platform provides real-time prices and other financial information about the company, as well as market news that could affect ABB's performance.

As of August 2021, ABB's stock price on NYSE is hovering around $34 per share, which is relatively stable compared to the past year. Despite the ongoing COVID-19 pandemic and supply chain disruptions, ABB has managed to maintain its revenue growth and profitability in recent quarters. The company's management team has also focused on improving its operational efficiency and reducing costs, which has positively impacted its bottom line.

One of the reasons that ABB has been able to weather the economic storm is its strong position in the converter business. This segment of the company has seen increasing demand in recent years, as more countries look to invest in renewable energy sources such as wind and solar. HVDC technology is crucial in transmitting power from these remote locations to cities and other populated areas, as it reduces the amount of energy lost during transmission and improves the grid's stability.

ABB has a significant market share in the converter business, with its systems installed in multiple countries such as China, India, and Germany. The company's competitive advantage lies in its advanced technology and expertise in planning and executing large-scale transmission projects. ABB's converters can handle high-voltage levels and long-distance transmission, which enables renewable energy sources to be integrated into the grid more efficiently.

Looking ahead, ABB is well-positioned to capitalize on the growing demand for clean energy and grid modernization. The company has already announced some ambitious projects, such as the world's longest HVDC transmission line in China and a major expansion of its converter factory in Sweden. ABB's management team has also highlighted the potential for further growth in robotics and automation, which could bring more revenue streams and profitability in the long term.

In conclusion, ABB Ltd is a solid company with a strong position in the converter business and other industrial segments. Investing in ABB's stock can be a viable option for those who are interested in the energy and technology sectors. By keeping an eye on the ABB depositary receipt chart and following the latest market news, investors can make informed decisions and potentially benefit from the company's growth prospects. Furthermore, the converter business of the company will continue to play a vital role in the global transition towards renewable energy sources, and ABB could be at the forefront of this trend.